Inflation. In the past year, this word has been repeatedly mentioned everywhere in virtually every form of media. Why is everyone talking about it? And why was this such a foreign concept to most people before February 2022?

Until quite recently, very few people in the West had direct experience with high levels of inflation. Unless you studied economics or history, inflation was nothing but a vague term occasionally associated with the economies of distant countries. For people used to the comfort and stability of the West, inflation was something that affects only developing countries, or so many people thought. Many poke fun at the trillion Zimbabwean dollar notes printed by the Mugabe regime in 2008. More recently, the world saw Venezuela go through hyperinflation. It is much more common to see periods of unstable prices in the developing world, since these economies are more prone to shocks. Few expected that Europe, the US and other parts of the developed world would see the return of high inflation.

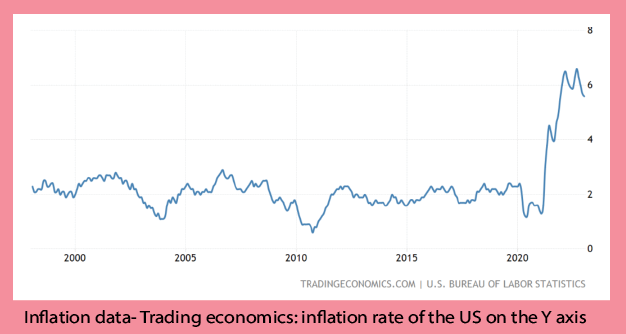

Why is this current wave of inflation so widely talked about? Why is this so important? For starters, this is the highest wave of inflation the West has seen in 40 years. The last time inflation was this high was in the 1980s. Prices have been relatively low and stable since. The era of globalisation and low-cost manufacturing abroad has brought inflation down to a record low. Double-digit inflation is completely unheard of for many people who were born from the 90s and beyond.

The graph shows us that the current wave of inflation in the US is the highest since the beginning of the 21st century.

Inflation is also seriously hurting developing countries. While inflation is not a new experience for the developing world, this current episode of price hikes has been quite unexpected and volatile. Inflation affects the middle and lower classes the most by eating into people’s savings. The pain is especially acute when prices rise for essential goods like food, commodities and petroleum products. Many economists have called off the alarm, saying that the worst is behind us. Inflation has peaked and believe it or not, it is falling. The latest data on inflation coming from the Fed suggests that the inflation rate is coming down, even though it is still a record high.

The precise causes of this current inflationary wave are intensely debated in economic and political circles. There were early warning signs: interest rates were at record lows since the pandemic, government spending rapidly increased to provide stimulus to the economy. Some economists warned that this massive flush of government stimulus money would drive inflation. The famous economist, Milton Friedman cautioned that “inflation is always and everywhere a monetary phenomenon.” The Covid-19 crisis caused supply shocks and a slowdown in most economies. Governments around the world reverted to the time-tested policy of increasing spending to combat the contracting economy. This injected a lot of money into the system.

There were already telltale signs that inflation was picking up even before the Russian invasion of Ukraine in February 2022. The spike in government spending during and after the pandemic has led to inflationary prices in developing countries. However, many academics believe that Western economies have moved past the stage when government spending could influence inflation. In a way, economies have become resilient to government interventions.

Just as supply chains were just slowly returning to normal in early 2022 and economies were just starting to speed up recovery from the pandemic, the war in Ukraine happened and created a double whammy on the global economy. Sanctions, food shortages and energy supply disruptions drove prices through the roof. People suddenly started feeling the effects of the war all over the world.

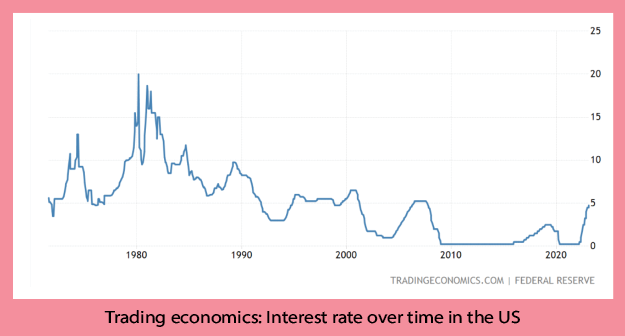

To reign in inflation, central banks increased interest rates. This is another time-tested policy used by governments facing high inflation. However, inflation still remains persistent, even though it has fallen from its peak. Helpless and without any alternative tool, central banks have continued raising interest rates, despite fears that doing so will dampen economic growth.

The resulting spike in interest rates came as a shock to many. When one looks at the data, interest rates are not at sky-high levels. In the past, there were periods when interest rates were much higher and remained high for a long time. The 1980s saw interest rates in the double digits. For comparison, current rates are still lower than it was during the lead-up to the financial crisis of 2008. But for the last decade, people became accustomed to very low-interest rates and when interest rates rose, many panicked.

Inflation was almost a forgotten word in Western discourse. The current inflationary crisis brought to the forefront some of the old challenges. Should we try something different this time?

Finally, most people are wondering whether this rise in interest rates is going to stay for a while. In the current situation, the chance of interest rates going back to pre-February 2022 levels any time soon is remote. This is because inflation is still high and the most important job of any central bank is to curb inflation. Central banks have typically done this by increasing interest rates.

Maybe people have to get used to the new reality that interest rates will remain high for a while. Maybe the era of free money is over after all. The impact of this move is still to be seen. The dissolution of Silicon Valley Bank (SVB) can be partly blamed on the interest rate hike. It awaits to be seen how high interest rates will affect other financial institutions across the world.

Written by Adithyan Puthen Veettil; Edited by Shaira Rabi

Photo credit to: Jason Leung, Unsplash